Career path to become a BAS Agent

Career path to become a BAS Agent

Our BAS Agent program is built to help practicing bookkeepers to add another income stream to their practices and fullfill TPB relavent experience requirements. All evidence shows that market prefers bookkeepers with BAS Agent licence.

We provide BAS Agent supervision and the provision of the required experience sign off means we can help you get your BAS Agent licence and provide you with experienced tax technical and practice management advice.

Why The Taxation?

We are Licensed Tax Agents willing to provide you with the supervision and training you require to obtain your own Tax Agent Licence or BAS Agent License. If you are a qualified accountant or a bookkeeper but not yet a TAX Agent or BAS Agent, we offer you the opportunity and provides training and course to become a Registered Australian BAS/TAX Agent. Other (and not all) benefits you receive when joining include:

- We setup a business name chosen by you with which you trade with your clients

- We provide Licensed Agent supevision which will in the end lead to you acquiring the necessary relevant experience to assist you to get your own BAS/TAX Agent Licence.

- You will have full access to our dedicated Head Office team.

- Business development support including marketing your own brand.

- Tax software access and training

- Computer equipment and IT support

Our Approach

- We set you up with your own practice name registered under one of our Tax agencies so that you can offer taxation services immediately under our supervision to your clients.

- We help you market your business through our own website and social media.

- We assist you in obtaining a Tax Agent Licence or BAS Agent License by providing the suprvision that the TPB require to allow you to practice.

- After joining us you get the opportunity to study and be suprvised whilst completing your CertificateIV in Bookkeeping, BAS Agent Skill Set or Tax Agent Skill Set and apply for your own license once completed.

- We ensure that you have access to our experience in diverse technical tax knowledge and efficient practice management methods

Outcome after Joining us

BAS Agent Registeration – Usually after one year (with the right application by you) we will assist you to obtain your own BAS Agent License.

TAX Agent Registeration- Usually after two years (with the right application by you) we will assist you to obtain your own Tax Agent License.

But equally important, with our support and assistance you should by the end of Program have the client base necessary to run a profitable tax practice.

Career Path to become a BAS Agent

Qualifications and experience for BAS agents

To become a registered BAS agent, individual applicants must satisfy certain qualifications and experience requirements, which are set out in the Tax Agent Services Regulations 2009 (TASR).

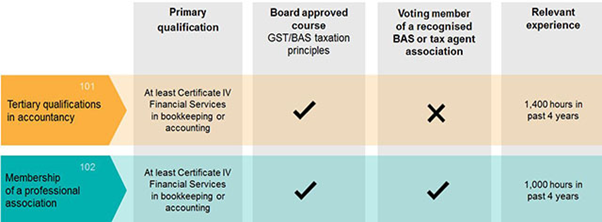

Summary of qualifications and experience requirements

You may apply to register as a BAS agent through one of two options outlined in the TASR (item 101 or 102) depending on your experience. The following table summarises the requirements under these items, covering:

- Primary qualification

- GST/BAS course

- Relevant experience

Primary qualification

You must have a primary academic qualification in bookkeeping or accounting at a Certificate IV level or a higher award (for example, a diploma, Advanced diploma or degree). The qualification must have been obtained from a registered training organisation or an equivalent institution.

GST/BAS course

You must also have completed a Board approved course in basic GST/BAS taxation principles (also known as GST/BAS course). This course may be included in your primary qualification. Your Board approved GST/BAS course should include a component in the Tax Agent Services Act 2009 (TASA), including the Code of Professional Conduct (Code). Otherwise, you must have completed a separate unit covering this component.

Relevant experience for BAS agents

You must have enough relevant experience in providing BAS services to register or renew your registration as an individual BAS agent.

What is considered relevant experience

Relevant experience can include work:

- as a registered tax or BAS agent

- under the supervision and control of a registered tax or BAS agent

- of another kind.

For your experience to count as relevant experience it must include substantial involvement in one or more BAS services.

BAS services include services that relate to ascertaining or advising about the liabilities, obligations or entitlements of an entity under a BAS provision or representing an entity in their dealings with the Commissioner relating to a BAS provision.

In addition, the service must be provided in circumstances where an entity can reasonably be expected to rely on the service to satisfy liabilities, obligations or claim entitlements under a BAS provision.

Most work in preparing the books and records of a business for the purpose of that business completing their BAS obligations, including their pay as you go (PAYG) withholding and instalment obligations, are considered relevant experience.

However, work in preparing a return for a state tax obligation, such as payroll tax, is not considered relevant experience

Work of another kind

We may accept work other than:

- as a registered BAS or tax agent

- under the supervision and control of a registered BAS or tax agent.

provided you demonstrate that your experience includes substantial involvement in providing one or more BAS services. Experience that may be considered under the ‘work of another kind’ category includes work undertaken as an academic teacher in relevant taxation laws.